Bonds Guide

How it works

Bond insurance is a convenient alternative to multisig escrow.Bond insurance allows sellers to voluntarily deposit a XMR bond to a bond holder. Buyers can then select bond insurance when making an order, with the assurance that they can get a refund (up to the bonded amount) in case of a dispute. This increases trust and gives your listings a green lock badge.

Disputes and Refunds

If there is a dispute, the buyer can click on "Request Refund" and the bond mediator is alerted and joins the bond chatbox. The bond mediator will then decide whether to refund the buyer (using the bonded funds), or deny the refund.If the buyer wins the dispute, the mediator alerts the bond holder, who refunds the buyer using the bonded funds. If the bonded amount is less than the order amount, the buyer receives a partial refund. If the bonded amount is greater than or equal to the order amount, the buyer receives a full refund, and any remaining bonded funds are forfeited to the bond holder.

If the buyer loses the dispute, the seller's bond is unaffected and can be used to insure future orders.

If there is no dispute, the bond is unaffected and can be used for future orders.

Validity

Bonds are valid for all of a seller's listings. It is recommended to deposit a bond equal to or greater than your listings' prices. Funds can only be used to insure one order at a time, so if you process multiple orders concurrently, a larger bond is advisable.Withdrawals

Each bond holder sets their own terms, deposit fees, expiry and renewal periods. Sellers may withdraw their bonds (minus the deposit fee) at any time, unless there is an ongoing dispute or the bond has been forfeited.After the bond expires, there is a renewal period where sellers can renew the bond or withdraw the bond. If the seller does not renew or withdraw the bond during the renewal period, the bonded funds are forfeited to the bond holder.

Fees

There are only two fees associated with bond insurance: the deposit fee and the renewal fee, which are paid by the seller. There are no additional listing fees, order fees or mediation fees.Limitations

Bonds can only be used to insure direct payment orders, not multisig escrows or instant digital downloads. Bonds can only be used when ordering a product or service from a seller. (Seller means the user who is receiving Monero. Buyer means the user who is sending Monero.) Bonds cannot be used when a seller is replying to a buyer's Wanted listing - to use bond insurance, the seller must make a Private Listing and the buyer must order it.Support

If you have questions, please contact XmrBazaar support by private message or email here.Screenshots

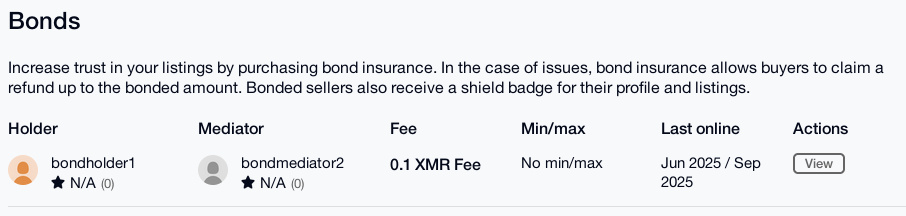

Screenshot 1: Bond ListingsSellers can view bond holders and bond mediators on this page

View full image

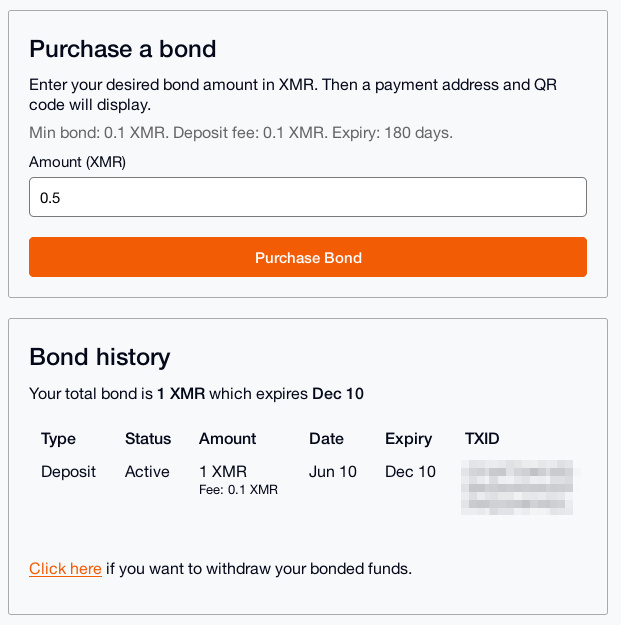

Screenshot 2: Purchase Bond

After clicking on a bond holder, the seller can view the bond terms, purchase a bond with XMR, and view their purchased bonds

View full image

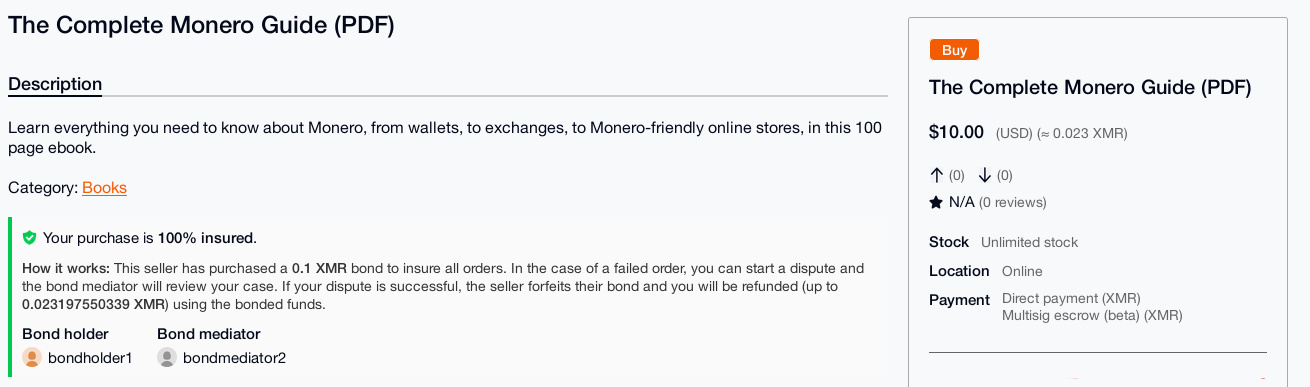

Screenshot 3: View Listing - Bond Info

If a seller has bond insurance, a Bond Info Box is displayed on applicable listings.

A green shield icon denotes a full bond, i.e. the buyer can request a full refund in the case of a dispute

Yellow and red shield icons denote partial bonds, i.e. the listing price is greater than the seller's total bond, so the buyer is only eligible for a partial refund

View full image

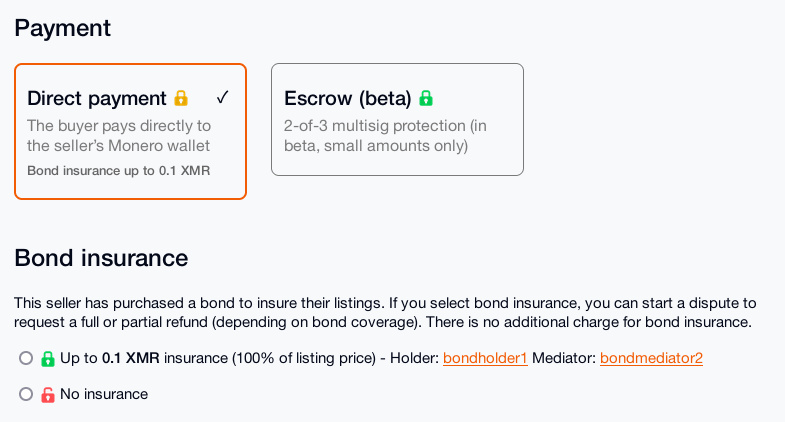

Screenshot 4: Order Listing

The buyer can choose to use bond insurance when ordering a listing. There is no additional fee for bond insurance.

View full image

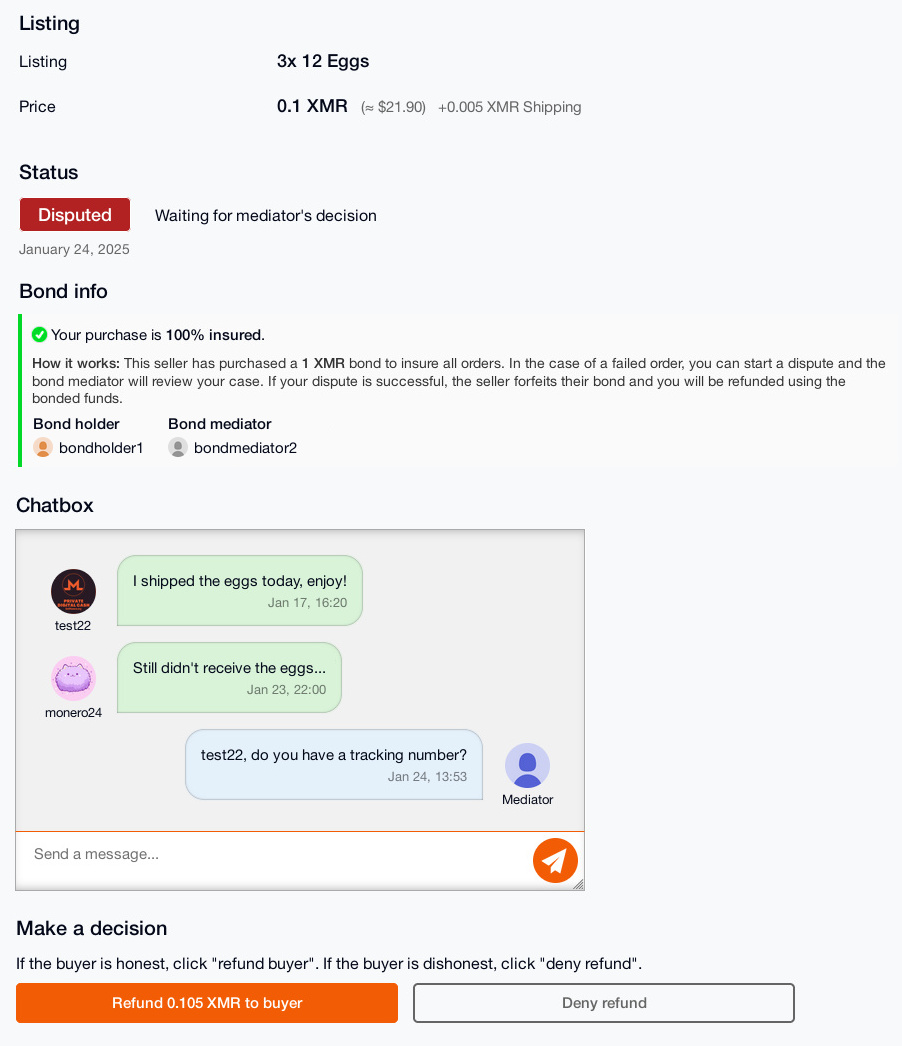

Screenshot 5: View Order - Bond Info

Orders with bond insurance include a Bond Chatbox where the buyer, seller and mediator can discuss the order.

The buyer may choose to start a dispute by clicking on the "Start Dispute" button while the order is in progress. Then the mediator must make a decision and then click on "Refund Buyer" or "Deny Refund". If the mediator grants a refund, the bond holder sends the bonded funds to the buyer's refund address and the seller forfeits any remaining bonds.

View full image