Tax residence in Paraguay

Description

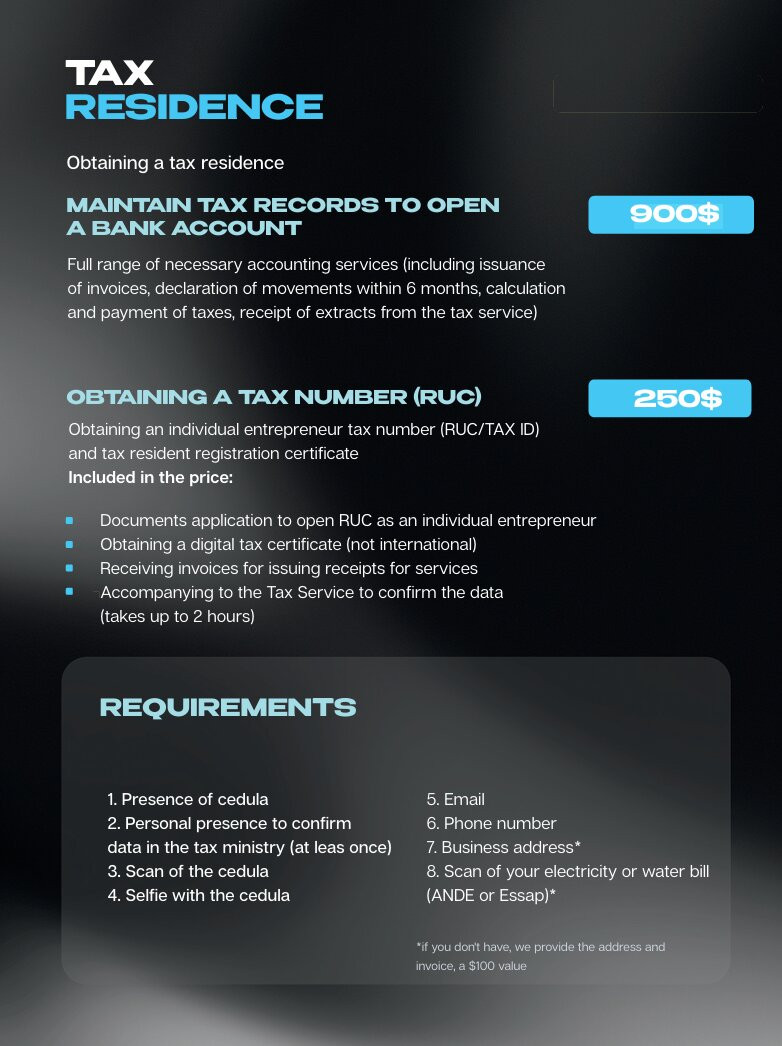

Service to open a Tax ID in Paraguay.

Why to be Tax Resident of Paraguay?

1) Territorial tax system: if you don't have any business related to Paraguay (money does not go through a Paraguayan bank and a Paraguayan IP address is not used when connecting to the internet), you don't pay any tax. So you can have a Tax ID and you can get an international tax certificate with 0 movements.

2) If you are offering services from Paraguay — for example, as a digital nomad or AI servers service (or using a Paraguayan IP address on your devices) — and exporting those services to foreigners or foreign companies (non-residents of Paraguay), then you pay only 10% tax on net income.

3) If you apply to be part of the Maquila program — which consists of exporting services or goods to foreign companies from Paraguay (only 10% of your total business activity may be sold within Paraguay) — then you will pay only 1% on imports and 1% on income.

4) If you are working in Paraguay and offer services or goods to Paraguayans, then you pay 10% VAT (except for pharmaceutical goods and basic food items such as milk, bread, oil, which will have a 5% VAT), + 8 to 10% tax on net income.

Tax ID in Paraguay is called RUC.

Category: Assistance

Tags: RUC, Paraguay, Tax ID, Tax residency, low taxes.

Published on: February 15, 2026

Views: 3

Legal Notice: Buyers and sellers are responsible for complying with all applicable laws in their jurisdictions. XmrBazaar does not verify legality and assumes no liability. Peer-to-peer cash-for-crypto trades are permitted if not conducted as a business and are compliant with local laws; otherwise, sellers must hold any required licenses or registrations. Listings involving fraud, violence, child exploitation, or other clearly illegal goods or services are strictly prohibited and will be removed once identified. Users are encouraged to report unlawful listings.

About the trader

Consultancy and legal services in Paraguay.

N/A

-----BEGIN PGP PUBLIC KEY BLOCK----- mDMEAAAAABYJKwYBBAHaRw8BAQdAcNIGLs48ACz0TImScIOMDNrfcxZPx/ILFTuD 7GJmAHa0F0xhdGlub01hbkB4bXJiYXphYXIuY29tiJQEExYKADwWIQSgX/6j5RF7 VaZI4ddqj5wREmIX6wUCAAAAAAIbAwULCQgHAgMiAgEGFQoJCAsCBBYCAwECHgcC F4AACgkQao+cERJiF+tmrwEA3KGVUXMti0Wo5sTT6mY7Bnp4yChHlmV9adMhwkke sv4A/jQVIEHzPjsrWnryHCxumpp2dlKe0E/H7t4LjwwqRIMJuDgEAAAAABIKKwYB BAGXVQEFAQEHQKKPd79lo5MhaheLua8E3q1BgSYBPjYsu8PhOHuKiTFJAwEIB4h4 BBgWCgAgFiEEoF/+o+URe1WmSOHXao+cERJiF+sFAgAAAAACGwwACgkQao+cERJi F+sE/gEA3latUKf+rCx5LnB2FMO0KivwzQONm6CA6VwwMd6X2aABANKRbtTO9HmL CbULqOf63vkSx9aiTGjlIAa3xqQ/fgML =9o8m -----END PGP PUBLIC KEY BLOCK-----